What are Texas monthly notices and how should they be sent?

As we covered briefly in our last lesson, Texas contractors and suppliers must navigate a lot of different “notice” forms and requirements. The most popular and confusing of them is the “monthly notice” requirement. This notice goes by a lot of different names, including a Notice of Non-Payment, Funds Trapping Notice, Preliminary Notice, Lien Notice, Pre-Lien Notice, and Notice of Intent to Lien. Further, since the “Monthly Notice” is sent monthly, they are also sometimes referred to by the delivery month, such as the “Second Month Notice” or “Third Month Notice.”

We’re going to call them the “Monthly Notice.”

In Texas, all subcontractors and suppliers must send a “Monthly Notice” to protect their lien rights on the job. In order to keep the right to file a valid Texas mechanics lien or bond claim, contractors and suppliers must send a monthly notice for each month of work they perform that goes unpaid.

The Texas monthly notice is designed to give the property owner notice that you are owed money on the job and has not been paid. The notice is sent only after you have been unpaid for your work for some time. Though the notice does not threaten a lien filing, it does give warning to the owner that you have not been paid, that your amounts are (likely) overdue, and that a lien could be filed. Naturally, therefore, these notices get the property owners attention.

A unique feature of these notices is that you may be required to send the notice multiple times. This can happen for two reasons:

- You are a lower tiered party and must send double-notice; or

- You are not paid for work that spans across multiple calendar months – as a separate notice is required for each month of work.

This means that, on an extended project, a company can be required to send a large volume of notices. What makes things even more complicated, when viewed in light of the confusingly drafted Texas statutes, is that some parties are required to send more than one notice for each month – and potentially, those notices may be required to be sent in different months.

Who is required to send monthly notices?

Anyone who is not contracted directly with the property owner likely has a monthly notice requirement. The graph below displays who is required to send monthly notices if unpaid on a Texas construction project.

As you can see from the table above, monthly notice requirements vary depending on your project tier and project type. To figure out which monthly notices you are required to send, ask yourself these questions:

- Are you a general contractor? If so, you may have some other notice requirements (which are discussed below), but you do not have any monthly notice requirements.

- Did the GC hire you directly? If so, you are a “1st tier subcontractor.” You need to send one monthly notice. If you’re on a residential project, the monthly notice is due “on the 15th day of the month two months after the month the unpaid work was performed.” If you’re on a non-residential (commercial) project, it’s due by the 15th day of the third month after the month the unpaid work was performed.

- Are you a lower tier party? If so, you have the most burdensome monthly notice requirements. On non-residential projects, you need to send a monthly notice in the 2nd month and the 3rd month. On residential jobs, you only have one monthly notice due in the 2nd month.

When should monthly notices be sent?

Now you know which Texas notices will be required depending on the project type and your role on the job, the next step is managing how and when you need to send those notices. This is the most burdensome element of the Texas notice scheme because it requires you to review your invoices each and every month, and to trigger notices every time invoices go unpaid for too long.

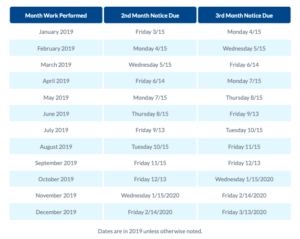

The statutory text reads that notices are due “on the 15th day of the month two [or three] months after the month the unpaid work was performed.” This language is very confusing, so below is a chart to help.

This table helps you figure out your deadline to send your monthly notices in Texas. The table of dates takes into count whether the 15th of the month (i.e. the deadline day) falls on a weekend or holiday, and shifts the deadline back to the prior business day, as the law requires.

Monthly notices must be sent for each month work was performed but not paid. Look in the first column to find the month when you performed work that is still unpaid, and then to the 2nd column for the “2nd Month Notice” due date, and the 3rd column for the “3rd Month Notice” due date. All dates are in 2019 unless otherwise noted.

Who needs to receive these notices and how should it be sent?

Generally speaking, almost all of the Texas Monthly Notices need to be sent to both the project’s general contractor and the property owner. If you’re sending a 2nd Month or a 3rd-month notice, therefore, and want to make sure you’re doing it right, then send these notices to the property owner and the general contractor.

There is an exception. For parties who did not contract with the general contractor (i.e. sub-tiers), the 2nd Month Notice need only be sent to the general contractor, and not the property owner. Accordingly, for this single specific notice, in this single specific circumstance, the notice needs only go to the GC. If your notice qualifies, you may want to do this to save money on mailing, and also to give the general contractor one additional chance to make payment before escalating the problem to the owner (i.e. the GC’s customer).

These notices are required to be mailed a specific way to specific required parties. All notices must be sent by regular U.S. certified mail. This is the required method of delivery in the law, which says that notices can be sent by “registered or certified mail.” Though it’s common to also pay for “return receipt requested” in the mailing, this is not necessary. Learn about the differences in mail types and how they meet or don’t meet requirements here: Construction Preliminary Notice Delivery Methods.

It’s important to note that just putting the notice into the mail satisfies the requirements and “constitutes compliance with the notice requirement.” Therefore, you don’t have to worry about your notices not being received by the deadline (i.e. 15th). It’s good enough if they are mailed before the deadline.

Also, even if you mail it incorrectly or otherwise make a mistake while sending, if the notice is actually received, you cure the mistake. As per the Texas statute, “[i]f a written notice is received by the person entitled to receive it, the method by which the notice was delivered is immaterial.”

Keep evidence of mailing

Since it is the mailing of the notice that is most important, you want to make and keep evidence of your mailing the notice documents. One good way to do this is to execute an Affidavit of Mailing at the time of mailing.

Once you put this notice in the mail, you’ll be done with all the requirements! Nice job. Keep an eye on your mailbox to make sure the delivery isn’t returned undeliverable for some reason. There are a few reasons why mail can be returned without delivery, and some of those reasons can be harmful to your lien rights.